U.S. Healthcare Challenges and Opportunities in 2023

In Part 1, we mentioned that a future blog would address the challenges facing hospitals, providers, and consumers. We will add payors, or insurance companies to that mix, because some are doing amazingly well, and some are not. In Part 2, we will focus our remarks on hospitals.

Of all the segments of healthcare in the USA, the challenges faced by acute care hospitals in America is overall the most severe. Hospitals are important because they are on the front-line for saving lives when people are the most vulnerable. In the USA, we have over 6,000 hospitals that manage nearly 1 million beds. In 2022, there were over 33 million admissions. During the peak of COVID-19, hospitals were stressed in ways they were never designed to be stressed: physically, staffing, and financially. We are now seeing some of those cracks actually break.

Inflation in the U.S. was not predicted to run the course it has been on, surely not by the Federal Reserve that announced just over a year ago, that inflation was “transitory”, yet this “transitory” inflation has caused monumental labor issues with staff seeking unprecedented raises and labor strikes not seen in decades. So, hospitals are trying to find ways of dealing with increased labor cost, while at the same time U.S. government programs (Medicare being the largest) have not only NOT adjusted for inflation, but also are actually cutting already nominal reimbursement rates by as much as 3% for many services including primary care, specialty care, and diagnostic services. This is on top of rate cuts sequentially every year. This is a worst case for hospital systems.

Many, if not all insurance and employer-based contracts, are either tied to Medicare rates or are negotiated in multiyear contracts, that have NOT adjusted, if they ever will.

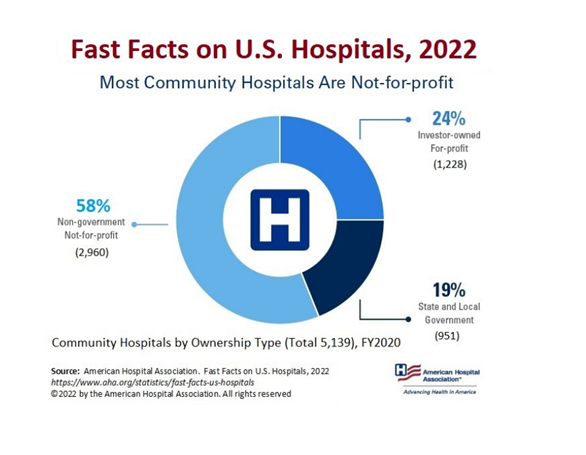

First, let us clear out a point about Hospitals in USA. Most hospitals in America are Not-For-Profit or Government owned. In fact, only about 25% of hospitals are investor owned or for profits.

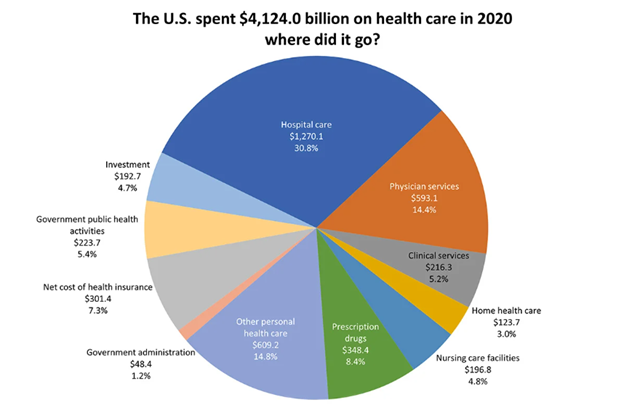

Second, hospitals are important as they represent over 30% of every healthcare dollar spent in the US healthcare system. In 2020, that number was over $1.2 trillion.

So, with all that money and most hospitals operating as non-profit status, why are they in trouble? The main reasons are complicated, and frankly no-one that we know predicted it. You have the burn-out caused by COVID-19 stress impacting doctors, nurses, technicians, and other hospital base staff. Also, hospitals have never had the impact, partly due to the supply restraints that have affected nearly all industries globally, and that leaves them with no ability to effectively control its supply chain costs, and with no ability to pass on the higher cost; i.e., no ability to simply raise prices to address the rapidly rising costs. Hospitals are not auto repair facilities; hospitals cannot simply raise the price of parts and labor to accommodate cost fluctuations due to inflation.

Look at this headline, “Texas hospital cutting almost half its staff, several services”[1]. This is just the tip of the iceberg, and the issues are only starting. See this news article of “21 Hospitals, Health Systems Cutting Jobs” [2].

Then you have actual declining hospital admissions, which is the principal source of revenue, down from 2019 levels. Also, it seems that some qualified elective and outpatient procedures are down. This is all having an impact on finances, and sets up a classic financial implosion – cannot control cost on the front-end or adjust pricing to address cost on the back-end all while revenue generations are dripping.

We expect a few very difficult years ahead for hospitals with a modernization to accommodate a more demanding consumer, and better user of technology to leverage the labor that remains. So far, the biggest trend we have seen is based in hospitals merging to both integrate their geographic coverage and to give them pricing capacity to negotiate with private payors. However, the U.S. government anti-trust regulators are very concerned. Clearly, the answer is to consolidate and achieve economies of scale in critical areas; however, doing could take them close to the edge of creating a monopoly as government see it, at least in some geographically restricted areas.

From our technology-based view, except for a few unique and specialized areas, hospitals have consistently lagged in modernization of their technology. Sure, most have not adjusted to the new consumed-based services, let us say it another way, they see the patient, not the consumer.

-Noel J. Guillama, Chairman

[1] https://www.beckershospitalreview.com/finance/texas-hospital-cutting-almost-half-its-staff-several-services.html

[2] https://www.beckershospitalreview.com/finance/17-hospitals-health-systems-cutting-jobs-february-2023.html